EXITS, IPOs, TRADE SALES: THE RETURNS OF STARTUP INVESTING

Achieving many successful and big exits is the goal of everyone who invests in startups. It is a sign that they know how to identify promising investment opportunities. Learn more about startup exits.

If you haven’t started investing in startups yet, here are the key points you should inform yourself about before starting.

WHAT IS A STARTUP EXIT

High-growth technology and science startups are funded by business angels and venture capital firms over many years and several financing rounds. Eventually, the shareholders of these companies “exit”. This means that they receive money for their shares either through the process of an initial public offering (IPO) on a stock exchange or from a so-called trade sale when the startup gets bought by another company.

WHY EXITS ARE IMPORTANT?

- Exits allow startup investors to realize the value of their holdings and to achieve a return on their investments.

- An exit is a sign that a startup is mature, successful, and valuable enough for a buyer.

- The number and size of exits are an indication of the strength of a startup ecosystem and its ability to produce, nurture and grow exciting and fast-growing companies.

- Successful exits also have an intangible value, inspiring budding entrepreneurs to try their luck. Every exit transports the message that you can succeed if you try hard enough.

NUMBER OF EXITS IN SWITZERLAND

Verve Ventures has gathered data on close to 400 exits in Switzerland since the early 2000s. Even though we try our best to get a complete and correct picture, the result will always be a bit foggy due to the private nature of these transactions.

Get the last version of the eBook “Startup exits in Switzerland” with in-depth analysis. Written by startup journalist Eugen Stamm.

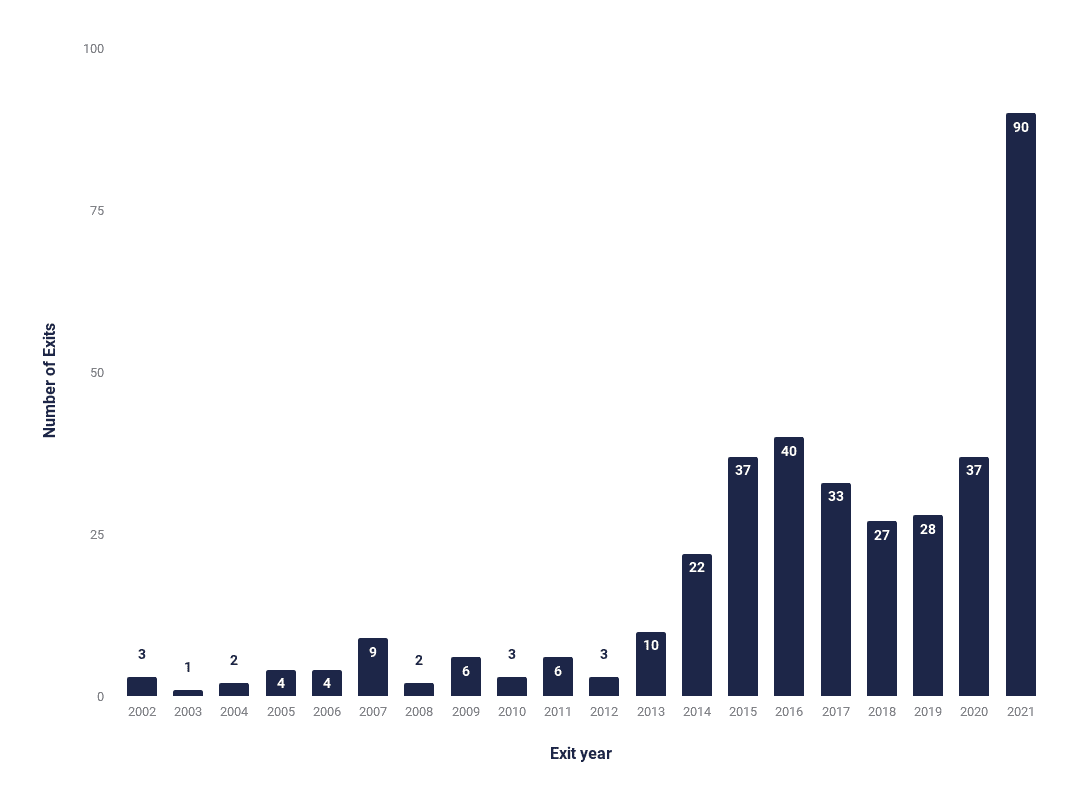

Count of Exits per Year

2002-2021

The number of exits has increased markedly since 2013 compared to the time before. There were, on average, around 32 exits per year in the period between 2014 and 2020. In 2020 we counted 37. The number increased significantly in 2021 and reached 91 exits.

Global M&A activity hit USD 5 trillion, an all-time high, breaking a record set in 2007 (of USD 4.4 trillion). In Europe, the number was up 50% compared to 2020. Technology and healthcare were the sectors that contributed most to the global M&A boom.

TIME TO EXIT

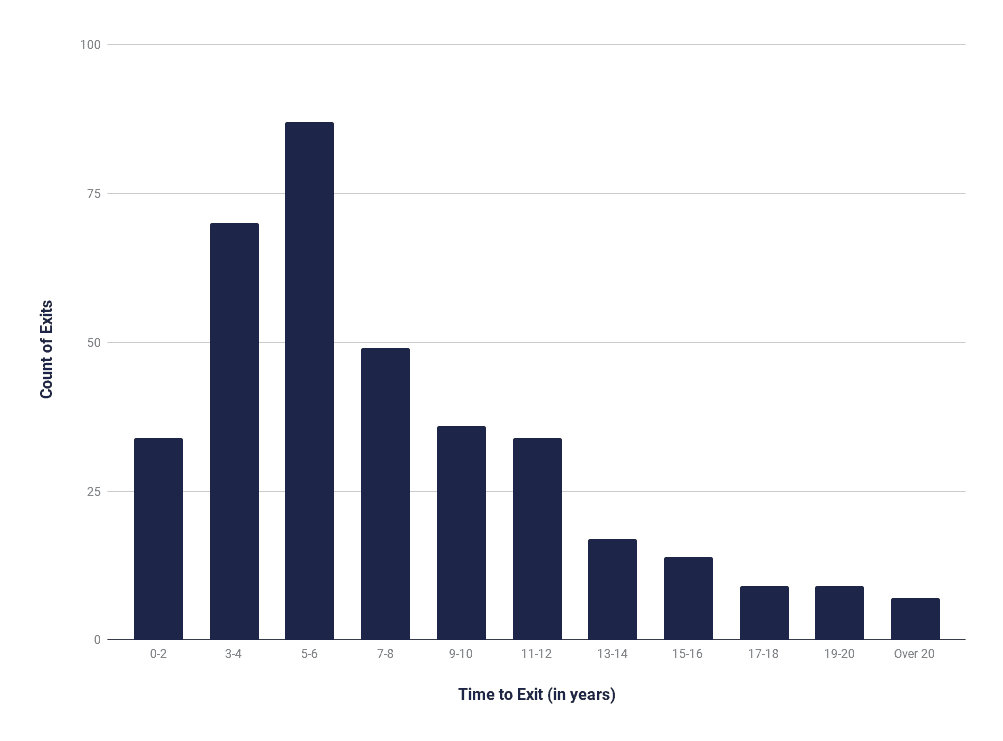

Time to Exit

Half of the startups that exit do so faster than 6 years from their incorporation and half take longer. Biotech and hardware companies take slightly longer to mature (with a median of 7 years) than software companies. Software startups can move quicker than startups that need to go through many iterations until their product is ready or need to follow a regulatory path with clinical trials.

The takeaway for investors is that you need a lot of patience and a time horizon of 10 years if you invest very early. Download our free eBook “Challenge of startup investing” to learn more about this topic and get ready to invest.

Invest in Startups

As one of Europe’s most active venture capital investors, we grant qualified private investors access to top-tier European startups. With investments starting at EUR/CHF 10’000, you can build your own tailored portfolio over time and diversify across stages and sectors.

WHEN IS THE RIGHT TIME FOR AN EXIT?

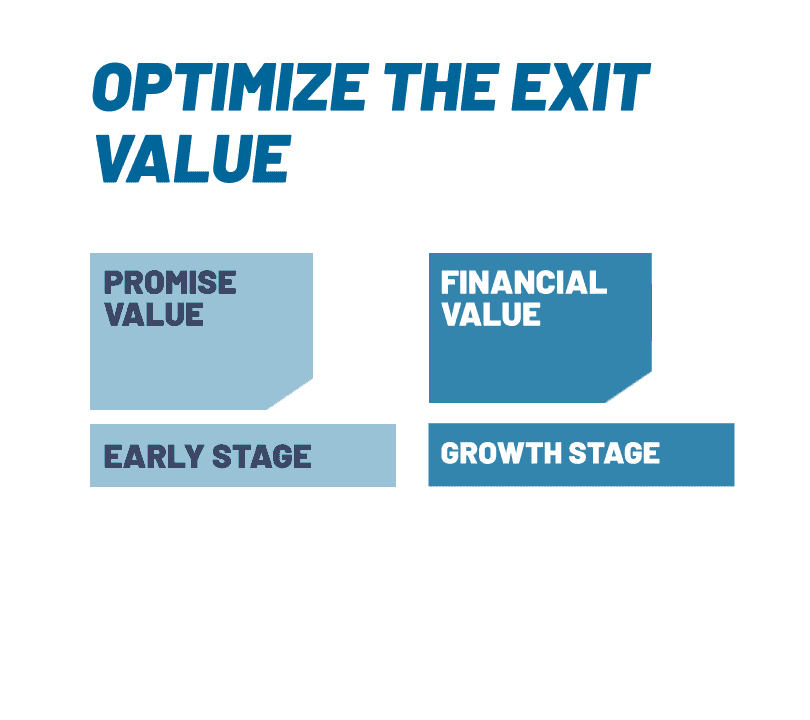

A useful mental model to think about the timing of an exit is “promise value” versus “financial value”. This distinction was termed by M&A advisor Jon Roberts. The first exit window comes early in the development of a startup when there isn’t a lot of commercial traction yet. At this stage, you may be able to realize a “promise value” exit where a buyer is willing to pay for what has been created so far.

A second exit window comes later when a startup achieves significant revenues and is still growing at a high rate. A potential buyer will then pay for the financial value of a startup’s future earnings.

EXITS BY SECTOR IN THE SWISS MARKET

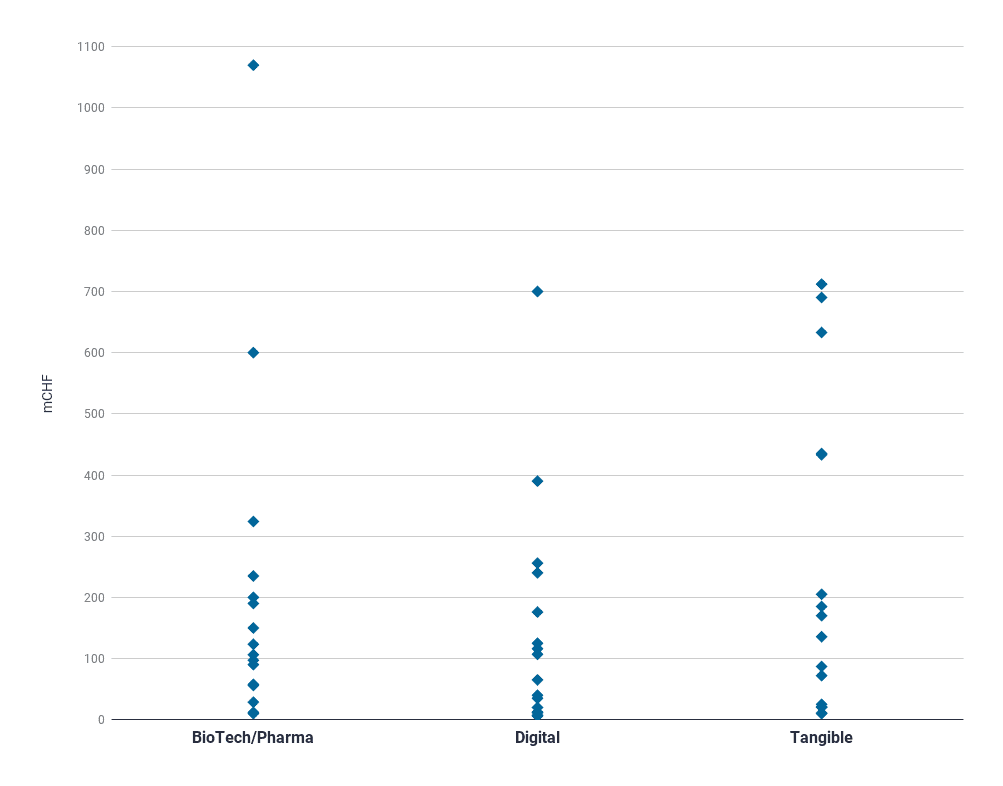

Distribution of disclosed exit prices per Category

Prices paid in Swiss exits by segment between 2002-2021

Software startups achieved the highest number of exits. In 2021, exits of digital companies were almost three times as numerous as their long-term average. The median exit price was CHF 48 million.

Exits of hardware startups take longer to manifest and are less frequent. However, the median exit price in this segment is a lot higher than for digital startups and amounts to CHF 170 million.

For biotech startups, the motto is “go big or go home”. Either these startups fail because the proposed new treatments don’t show the efficacy that was expected, or they successfully complete their clinical trials with promising data, and get bought for a lot of money.

AN OVERVIEW OF SWISS EXITS

Verve Ventures has systematically tracked exits of Swiss startups since 2000. Download the free eBook “Startup exits in Switzerland” to get a complete overview of this data.

The exit activity in Switzerland has grown considerably in recent years and reached new heights in 2021. This is a very good sign. It shows that startups are drivers of innovation that are relevant for more and more buyers across the globe. It is also the result of more and more venture capital flowing into the Swiss ecosystem over the past years.

Also, Swiss entrepreneurs have become more ambitious. While trade sales are still the predominant exit route, IPOs have become more prominent than they used to be. IPOs are the exit route that permits the founders to keep their shares (and the corresponding control) of their company and continue to grow it.

SOME EXAMPLES OF EXITS FROM VERVE VENTURES PORTFOLIO

Verve Ventures invests in startups that are based on scientific excellence and have a significant positive impact. Verve Ventures’ mission is to identify such startups and support their founders on their entrepreneurial journey.

Here are some exits examples from our portfolio.

Onward

Onward is developing therapies to deliver targeted, programmed stimulation of the spinal cord to restore movement, independence, and health in people with spinal cord injury, ultimately improving their quality of life. In November 2021, Onward listed on Euronext Brussels. Read more in this article.

Bring! Labs

With Bring! Labs‘ Shopping and Productivity App, users can create shopping lists on their smartphone, tablet, smartwatch, and on the web, share lists with others, and plan their grocery shopping together. The app has been awarded several times with the prestigious Google Play “Editor’s Choice” award. In September 2021, Swiss Post announced the takeover of Bring! Labs. Read the (short) story of another of Verve Ventures’ successful exits.

Astrocast

Astrocast is developing the most advanced global nanosatellite IoT Network to tackle challenges in industries such as agriculture, energy, fishing, connected vehicles, and IoT devices. In August 2021, Astrocast listed on Euronext Growth Oslo.

In this booklet, we share some of the exciting exits stories from our large portfolio of over 140 science and technology-driven startups. We highlight those that have returned capital to investors through an exit between 2021 and the first months of 2022.

As one of Europe’s most active venture capital investors, we grant qualified private investors access to top-tier European startups.

Invest in Startups

As one of Europe’s most active venture capital investors, we grant qualified private investors access to top-tier European startups. With investments starting at EUR/CHF 10’000, you can build your own tailored portfolio over time and diversify across stages and sectors.