As governments, corporations and consumers alike set their sights on meeting the Paris Agreement’s goal of limiting global warming to below 1.5 degrees Celsius, climate tech has emerged as a critical mechanism to curb emissions. Over $60 billion were invested in climate tech in the first half of 2021, a 210% growth in investment year-on-year. Isabella Fandrych co-founded Nucleus Capital, a venture company specializing in climate tech investment. In this interview, she tells us more about what makes climate tech a resilient investment in turbulent times and the many funding opportunities available for startups in this space.

Co-Founder, Nucleus Capital

Isabella Fandrych is the Co-Founder of Nucleus Capital and a climate tech angel investor. She worked as a consultant for McKinsey & Company for four years where she helped large German corporations transition towards digital business models and to embark on decarbonization journeys. While there, she became particularly interested in sustainability and decarbonization in the manufacturing space. This led her to become an angel investor in climate tech and ultimately co-found her own venture capital firm tackling resource inefficiencies in the food and industrial technology space. She has a bachelor’s in industrial engineering and management from the Technical University of Berlin, a master’s in Finance and Economy from the London School of Economics and a PhD in management from the University of Dusseldorf.

How did you become an angel investor?

I became very interested in topics such as digitalization and decarbonization in business and spent a lot of my free time researching them. I discussed emerging trends at length with my now business partner, Maximilian Bade, whom I met in high school. Max had already been very active in the VC scene for some years and had started investing as an angel. Gradually, he started talking to me about the deals that he saw, encouraging me to talk to founders and understand their business model. Not long after I started co-investing with him as an angel in his syndicate.

How did you transition from being an angel investor to founding your own VC?

It was really a question of how I wanted to spend my time and energy. I felt that I could have some positive results working with corporations, but I could have a higher impact if I worked with founders who have this 100% mission-driven approach and are fully committed to changing one small piece of the equation. Max and I decided to take the risk and build our own VC company. We’ve always wanted to found a company together and it just made a lot of sense to combine our skills and expertise to build a firm that supports founders early in their journey.

Does Nucleus Capital only specialize in climate tech? Or do you back other kinds of startups that you feel have a good vision?

We back pre-seed and seed startups in three areas that touch on planetary health and resilience. Number one is food tech. Number two is climate tech. And number three is enabling technology in the biology space. All the startups we work with should have a positive impact either on food security or on reversing or slowing down the effects of climate change.

Climate tech is a very big field. Are there any topics that you are particularly passionate about?

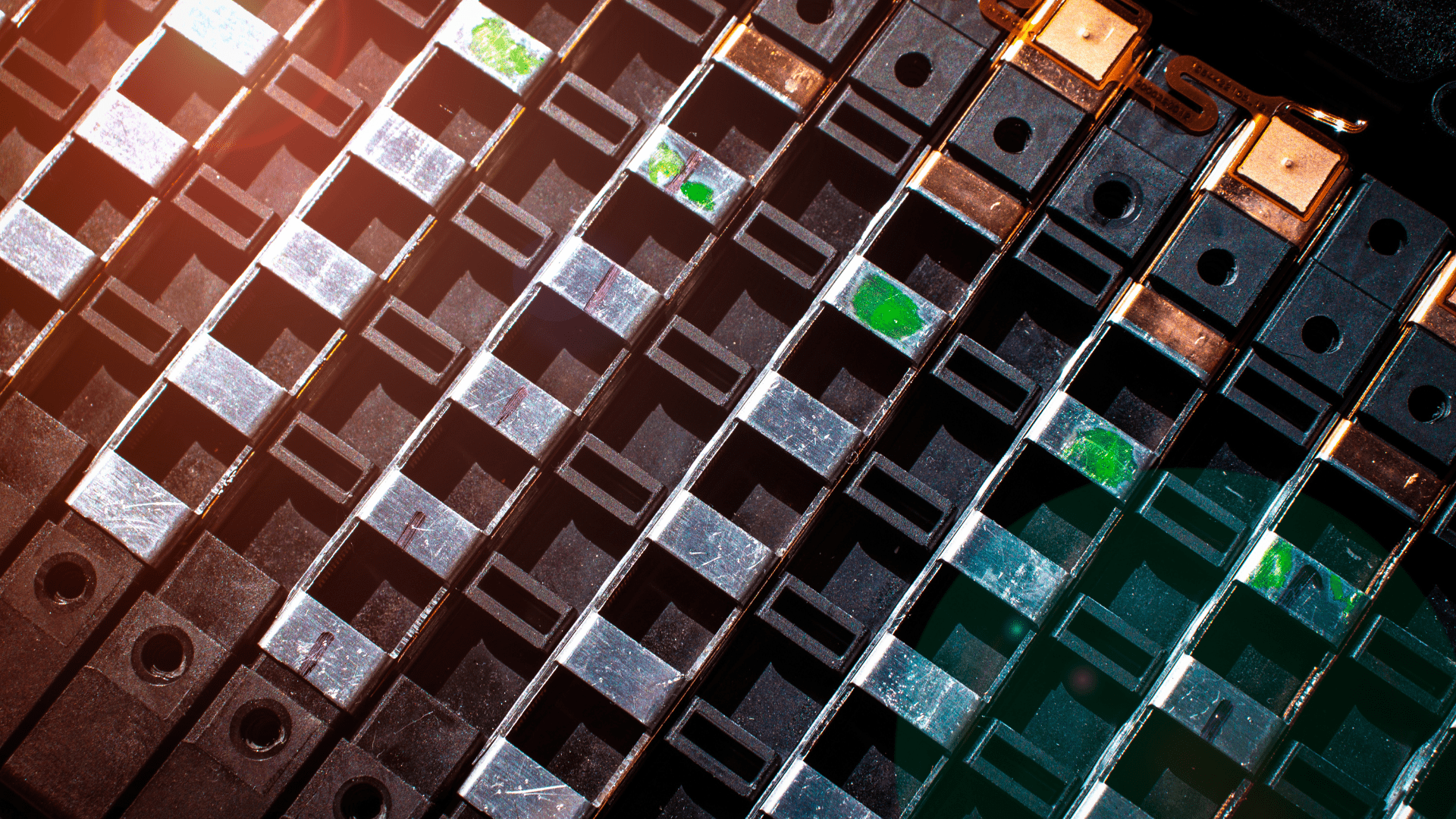

One big topic we’ve been looking into extensively is batteries. The way that batteries are produced, the way they are recycled, upcycled, maybe sometimes reused if they haven’t reached the end of life yet. Also, how do you create transparency in the supply chain so that you know where the materials come from? We’ve been looking into these topics a lot. We also like to talk to founders who are in the alternative materials space. The textile industry has huge emissions, so does plastic. Cement manufacturing, for example, is responsible for 8% of global emissions. If you found a way to produce cement in a more sustainable way, you could have a huge impact while lowering production costs because it’s a very energy intensive industry. We are also interested in carbon capture. We cover a pretty broad range, but there are topics we don’t really look into much such as mobility or real estate management.

What do you look for in a climate startup?

We like to have a team of founders. The ideal composition is one person with a technical background and one that has more business acumen. The technical team member would ideally have a PhD in a certain field and maybe already have worked in a startup or in the industry before. The second founder doesn’t necessarily need to have a degree in business but should have an understanding of how to create a business model and build up an organization. Then we also look at the type of advisors that a startup can attract. If you are a startup that is looking to innovate supply chains, ideally, you should have one advisor who really knows all the ups and downs of supply chains, and still has very good ties within the industry that could prove an advantage when selling your product or technology. When it comes to technical teams, we also look for someone who knows how to scale. When you have ideas coming out of university labs, bringing them to an industrial scale is very hard. Getting to the first pilot plant is doable and many teams succeed in it, but getting from there to an industrial scale requires a lot of capex. We therefore want to see either an advisor, co-founder or key hire that knows how to do that.

Take Planet A foods as an example: Planet A foods is working on cocoa-free chocolate, to eliminate the stress posed upon our natural resources tied to the production of cocoa beans. The founding team has quite a unique set of expertise. Max, the CEO, has a PhD in engineering, has worked in the production industry for several years and has experience with setting up production plants. Sarah, the CTO, has a PhD in Food Chemistry and has worked as Principal Scientist in a food tech startup before. Their backgrounds combined bring a truly unique set of skills, combining science, start-up expertise, and industrial scale.

You are based in Germany. Is there something that differentiates it from other markets when it comes to climate tech?

I think that in Germany we have a very strong focus on manufacturing. As a consequence, we see a lot of startups looking to solve issues in this space. The challenge for these types of companies is that, if they have high capital expenditures planned, European investors are hesitant to fund them. However, I feel this is changing. A great example is tozero. They devised a new method to recycle ion-lithium batteries and that means they clearly need to build up factories. And still, they created a lot of conviction among investors.

In general, I think in Germany there is funding for the first few rounds. So up to series A, founders can turn to investors within Europe. But because climate concerns cannot be solved with software alone, you need a lot of capital to grow, because you need materials, hardware and research and development. And for that reason, startups need to start thinking about turning towards US investors in later rounds. However, I believe startups within our investment focus are in a good place right now. Many funds were raised last year for climate tech, especially for later stage startups and these funds need to deploy their capital within the next four years.

The deep-tech VC of choice for entrepreneurial investors

Since 2010, we have invested in 180 European deep tech companies based on topical experience. With a highly skilled team of investment professionals, we back outstanding entrepreneurs driving growth in key industries. Verve is the pioneer of deep tech in Europe.

Do you think that EU legislation has an impact on climate tech investment in Europe?

Yes, absolutely. There are more and more regulations being adopted. For example, there are EU regulations pushing towards electric vehicles rather than internal combustion engines as well as new recycling quotas for batteries and plastics. There is a clear push for more climate-conscious policies, and this will change how many companies think about their future and how they do business. And that provides a lot of opportunities for startups to go into that space. This push is complemented by the pull of the customer. There is an increasing awareness of climate change among consumers, especially the younger generations, and a willingness to pay slightly higher prices for products that are more sustainable. As an example, when you look at the meat and dairy industry, they’re responsible for roughly 14% of CO2 emissions worldwide. The younger generations are aware of this and are increasingly inclined to use alternative products such as oat milk and vegetarian and vegan foods.

What are some of the key developments you think are coming to climate tech in the next five years?

I think on the one hand, we really need to think about how to avoid emissions and on the other, how to capture the emissions that are already out in the atmosphere. When you think about avoiding emissions, the energy transition is probably the biggest and most pressing part. So thinking about electrification in many industries, finding ways of producing green hydrogen cheaply to address the aviation, steel, and chemistry market. And then there are more and more carbon capture solutions. Some of them are very energy intensive, and therefore not ideal. But then there are also some solutions that use less energy like one of our own portfolio companies, Ucaneo. They have a great approach where they use biotechnology that requires way less energy to capture carbon. It’s still in the design phase, but within the next 5 to 10 years, I think we will see a lot of these solutions coming up.

Do you think that carbon capture is really part of the solution? Even the largest solutions currently on the market barely make a dent in overall global emissions.

In the latest report of the Intergovernmental Panel on Climate Change (IPCC) earlier this year, even under a rather positive scenario, we will still have some industries that we cannot fully decarbonize, where we will still be emitting high amounts of CO2 by 2030, and even by 2050. And we will have to capture that CO2 to avoid further increase in temperature. To cover that, we need to find solutions that capture carbon at scale. Currently, all these technologies are still nascent. Climeworks is the most well-known, but there are many other players emerging right now. Some of them have less energy intense approaches than others. Ultimately, it will all boil down to cost. How cost efficient are these machines and mega factories? But I think carbon capture must be part of the solution because we cannot decarbonize every step within industrial production. Currently, we don’t have great solutions to decarbonize steel or to reduce some of the chemical manufacturing emissions. As an example, reaching hydrogen aviation will also take a very long time as you need to change the entire infrastructure, the airports and the airplanes. Therefore, carbon capture must be part of the solution. We can’t rely just on nature-based solutions such as reforestation. It’s not enough.

I think the challenge for investors is to take the time to do proper due diligence before they invest in a company.

There is a lot of enthusiasm for climate tech right now and, as you said, a lot of money is being raised for it. 15 years ago, when solar panels first appeared on the market, there was a fervor and it led to a spectacular bubble burst. Do you think the same might happen with climate tech?

15 years ago, the solar power industry was just starting and some of the technologies were entirely new. And it just took way longer to mature than people expected. When it comes to climate tech, I think the situation now is different. As we already discussed, there is a regulatory push behind it as well as a strong pull on the consumer side. We can also de-risk technology to a certain extent if we rely on some of the technologies that have been proven in other fields. I think all these things together make climate tech a lot more resilient than the solar panel technology 15 years ago.

It’s also true that there is a lot of cash that needs to be deployed into startups in the climate tech space right now, just because a lot of money was raised. The real question is, are there sufficient good teams that can be funded with all this money? I think that some startups might get backed that wouldn’t have been a few years ago, just because there’s more money available now. Therefore, I think the challenge for investors is to take the time to do proper due diligence before they invest in a company. It’s easy to get excited about something just because there’s a general hype, but at Nucleus – and I believe at Verve Ventures you do the same – we really like to look into the details of a company and we try to understand every single bit of the value chain to decide whether this is a good investment or not. That’s our key priority.

Can you elaborate on what you mean by de-risking technology?

For example, many of the alternative protein companies are using precision fermentation. That’s a technology that has been around for many years and has been used in the pharmaceutical industry to create insulin. Now, the food industry is taking this kind of technology and translating it to protein creation. They have all kinds of different approaches, but essentially they’re using established machines and processes. They don’t necessarily need to adapt them, and they have less risk that they cannot scale up production because it’s already a proven method. This does not apply to every climate tech startup, but when we think about investing in something that is more hardware intensive, we always consider whether the method has been de-risked in some way.

Do you feel like the current market environment will impact climate tech funding?

I firmly believe that climate tech is resilient to economic crises. It will always be relevant and everyone understands that we’re just starting to really push these topics forward. And there is a lot of economic damage if we don’t mitigate some of the risks. Therefore, I believe it’s a more resilient vertical than others. However, given that interest rates are rising, startups with high capital expenditure might have a harder time securing sufficient funding to really scale in later rounds, where they need to scale to industrial plants, for example. But generally, I think the trend and the sentiment on this market is very positive.

Written by

WITH US, YOU CANCO-INVEST IN DEEP TECH STARTUPS

Verve's investor network

With annual investments of EUR 60-70 mio, we belong to the top 10% most active startup investors in Europe. We therefore get you into competitive financing rounds alongside other world-class venture capital funds.

We empower you to build your individual portfolio.

More News

19.09.2022

A new era in lithium-ion battery recycling

With 30 million electric vehicles expected to hit European roads by 2030, recovering critical materials from lithium-ion batteries has become a key part of decreasing the environmental footprint of electrification. tozero has developed a proprietary process that enables the recovery of all critical materials, including lithium.

07.09.2022

ClimateTech startup tozero raises €3.5m in funding

ClimateTech startup tozero raises €3.5m in funding as the first European startup to recycle lithium-ion batteries. The pre-seed round was led by Atlantic Labs. Verve Ventures, Possible Ventures, renowned business angels, serial founders and a former VW board member aslo joined the round. tozero introduces a novel process to recover critical materials such as lithium, nickel and cobalt from lithium-ion batteries.

03.08.2022

What is the impact of the current economic situation on startups?

This article is based on a webinar Verve Ventures held in June 2022. David Sidler interviewed Michael Lütolf about the implications of the bear market in public equities on private companies' valuation.

Startups,Innovation andVenture Capital

Sign up to receive our regular newsletter and learn about investing in technologies that are changing the world.