Stefanie Breuer

What motivated you to pursue a career in Finance?

I am someone who trusts my gut feeling. My original dream was to become a chef. I even worked in a Michelin-starred kitchen after high school and imagined opening my own restaurant. But my father and that chef said the same thing: “You don’t come from a family with money, nor a family with a restaurant. If you want to create something of your own one day, start by building financial independence and business know-how.”

So I went to St. Gallen and studied banking and finance; it wasn’t an easy decision, but I don’t regret it. I was fortunate to join Partners Group straight after university. Back then, it was still a small, relatively unknown, hands-on, entrepreneurial firm. I liked that private equity was not just about money but about transformation. I had the freedom to move, build, and learn. I started setting up the business in Spain at 26, worked across asset classes, continents, and collaborated with clients ranging from family offices to institutions. I like variety. I like change.

What made you decide to join Verve Ventures as a board member?

It was an intuitive decision. When I met Lukas and Steffen, I could immediately feel they were grounded and value-driven. They had entrepreneurial fire without ego. I knew I wanted to work with them.

Verve is not an impact investor, but many portfolio companies directly improve human health or environmental outcomes. We are living through a systemic shift – the old world is dissolving. Supporting startups that build the future we want to live in feels not only exciting but essential.

You have also been working as a female leadership coach. What was your motivation to pursue this?

It started when I led the European women’s network at PG. I was one of the few women in leadership in the firm. But it’s not just about gender – it’s about how we lead.

Finance is intense. I was flying so much that sometimes I’d wake up not knowing what city I was in. Add to that the constant fundraising pressure, and you end up in a chronic stress loop. Many ambitious people carry this belief that they’re never enough, always trying to prove themselves. If you don’t reconnect with your body and regulate your nervous system, it will break you down.

I had to learn to calm my system and set boundaries. I worked with a coach and eventually became one. Today, I share those tools with others. This work is about remembering your strength, not pushing harder, but anchoring deeper.

You have two decades of experience in private markets. During this time, private markets have developed from a niche to a central pillar of investing. What are the main factors that contributed to this stellar rise?

I believe that several factors contributed. First, institutional investors value the reduced short-term volatility in private markets, which helps with long-term planning and reporting. Second, private markets have historically delivered higher returns than public markets, particularly when investments are actively managed.

Control is another differentiator. Private equity managers can directly influence strategic decisions such as capital allocation, operational improvement, and governance, unlike public shareholders, who often have limited influence. Finally, access has improved: private markets used to be the domain of large institutions, but today, high-net-worth individuals and family offices also participate actively.

Isn’t the illiquidity of private market investments still a hurdle for private investors to get involved?

It should not be. If you are an investor in public markets, in my view, you should only invest money you can deploy with a time horizon of at least 10 years. Otherwise, it’s simply not worth it. So the investment horizon of public and private markets, in a way, is the same. When you invest in a private markets fund with a typical structure, you need to manage the cash for the capital calls. That is the only bit that is trickier. Otherwise, the illiquidity of private markets is just a psychological hurdle people should overcome. If someone finds the cash management for fund investments difficult, the direct investments Verve offers are a lovely proposition. Other funds don’t typically offer the possibility of co-investments if you don’t give them money for a fund. This is one more reason why I decided to join Verve, because this approach is unique.

You spent considerable time building up PG’s family office business. What is their appetite for such direct investments in venture capital?

They’re incredibly diverse. Multi-family offices tend to be cautious and structured. Single-family offices vary depending on the generation, cultural background, etc. Founders often want direct investments and love building something themselves. Later generations may prefer delegation and stability.

But in general, family offices are used to complexity and illiquidity. Their wealth was often built in private businesses – they understand the game. And increasingly, they want their investments to reflect their values.

Verve positions itself as an external team for family offices interested in direct venture capital investments. We have family offices as limited partners in our funds. In contrast, others work with us deal-by-deal, especially if they are interested in getting exposure to specific topics.

That makes sense because unless you are a really big family office, you will not build up a private markets team that includes seasoned VC investors.

Are there any cultural differences between family offices based on their location?

From what I have seen over the years, U.S.-based family offices tend to be highly sophisticated in their due diligence processes. Some Nordic and Western European families are comparable in their approach. In other regions, relationships and long-term trust play a more significant role.

Unlike institutions, family offices typically don’t face deployment pressure. That makes relationship-building critical and rewarding over time.

In Europe, pension funds still invest almost nothing in venture capital, whereas US-based pension funds are very active. Europeans repeatedly complain that US VC funds harvest most of the value created by state-funded European research, the only investors who can finance large growth rounds for European startups. If European pension funds were to invest 1% of their assets in European VC firms, this would change dramatically.

Investment decisions in a pension fund must go through many layers of hierarchy to get approved. Once you have an allocation for venture capital, it is easier to deploy money. Furthermore, pension fund managers are not incentivized to diversify their portfolios more than necessary into non-traditional assets. The only way to change this behavior is top-down. It should be mandatory for every pension fund to invest in venture capital at least when it comes to innovation in their own country or region.

You mean by law? That would run very much counter to the economic liberalism on which at least the Swiss pride themselves.

Yes, because otherwise, it will never change. People do not realize how far the European economy is behind the US regarding venture capital, innovation, and entrepreneurship. There is an urgency to act. As you have pointed out, venture capital funding is crucial to commercializing innovation. It is a key factor in the economic development of Europe’s economies. So, I think pension funds should be obliged to invest in venture capital.

Luckily, some pioneering pension funds have already invested with Verve Ventures. Until this becomes common wisdom, what about the role of private investors?

The average private investor relies on their bankers for advice. Hence, bankers must educate themselves and their clients about venture capital. The deal-by-deal model is a unique offer. Banks could use it to differentiate themselves from others. But here again, top-down decisions are needed. The good thing is that many self-directed investors have found Verve and signed up following recommendations from people they trust.

Verve has a pull because new technologies and companies are inherently interesting for private clients. They are entirely different from the blue chips they usually invest in, giving them a glimpse into the future. It should be evident that many of the blue chips will also be disrupted by innovative companies. Knowing what happens in venture capital makes you a better public market investor.

One segment of private clients interested in startups is the next generation of wealth holders.

This is no surprise. They think differently. Many of them no longer want traditional careers in law, medicine, or banking. They’ve grown up seeing entrepreneurs succeed, and they’re asking better questions. They want to drive change and see startups as a way to do that.

And they are digital natives.

Indeed, a state-of-the-art digital offering like the one Verve has built in-house speaks to them. For the next generation, a digital process is an absolute must-have. But in the finance world, so much still is done in Excel list,s and sometimes even filling out paper is still necessary. Verve’s digital platform is way more advanced than other processes out there.

What would you recommend to people who want to start investing in venture capital?

First of all, consider the societal relevance of investments in new technologies in fields such as energy and health. Then, find out if you would rather do direct or fund investments. With a fund, you can relax, because you are diversifying automatically. Direct investments are a very good way of getting to know a manager like Verve, how the team operates, and what they look at in their due diligence. You will find much information about this on Verve’s platform once you’ve signed up and can get acquainted with the team and their thinking. But diversification is a must if you do deal-by-deal; you don’t want to just do one or two investments, because then, the returns of your investments will be much lower than what you can achieve with a diversified portfolio.

Our Investment Topics

Resilience inEnergy & Resources

Our future success in fields like computing and pharma relies on a resilient energy infrastructure. We focus on disruptive innovations that leverage collaboration with leading enterprises to scale the next industrial base.

Future ofComputing

Our progress in various fields, from everyday use to pharma and research, is increasingly driven by computing capabilities, driving a huge demand for compute.

Frontiers inHealth & Bio

Advances in healthcare and life sciences are increasingly driven by the convergence of biology, engineering, and data. This convergence is unlocking more precise, efficient, and accessible solutions for patients.

Insights about European deep tech innovation

From Bern to Global Impact: Looking Back at Our Journey with Ikerian

We are thrilled to announce that EssilorLuxottica has acquired our portfolio company Ikerian (operating under the RetinAI brand). This exit marks a major milestone for the Swiss and European deep-tech ecosystem.

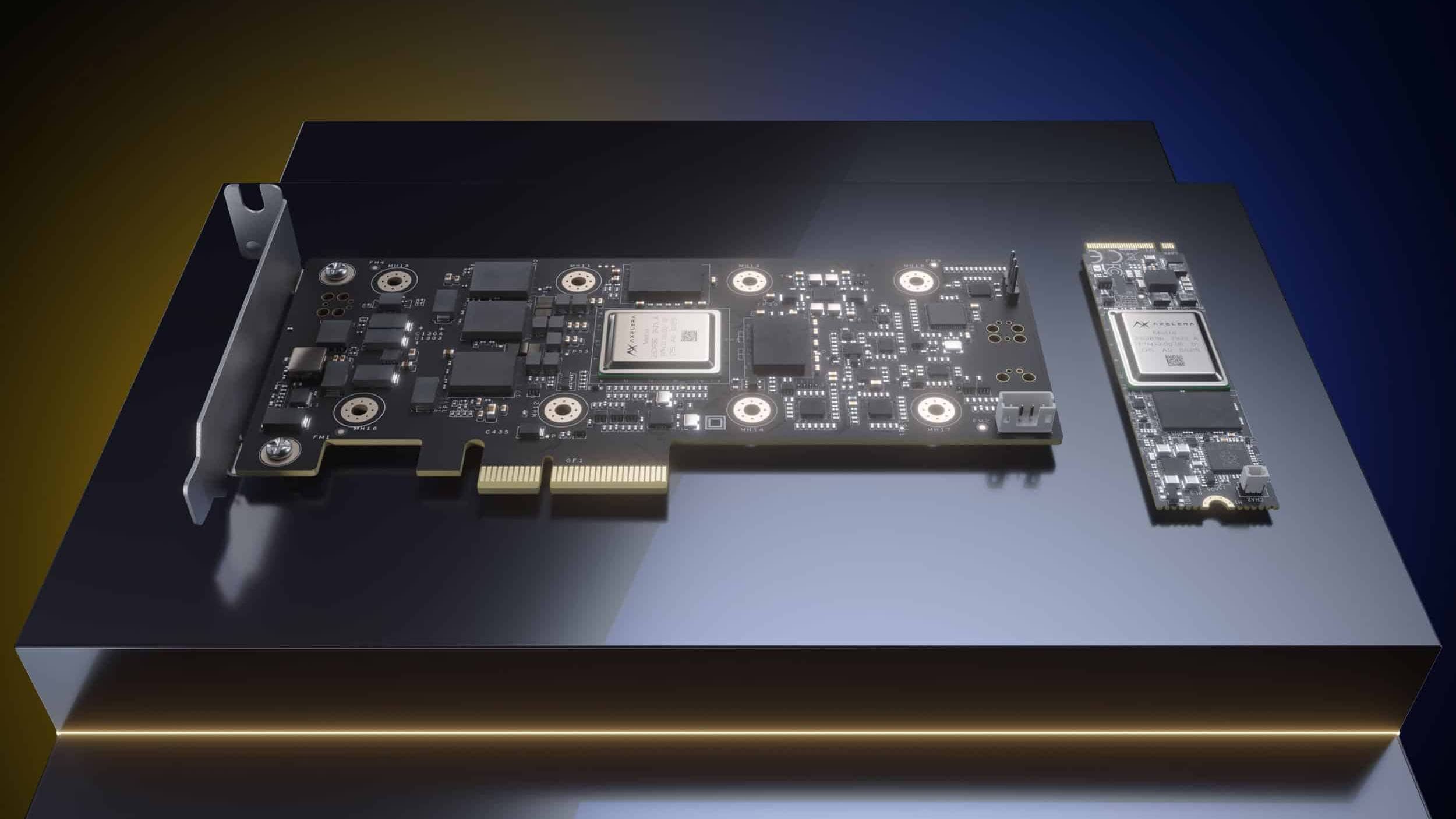

“Axelera will become a cornerstone of European AI sovereignty.”

In four years, Axelera has developed and launched its Metis AI accelerator chip, raised more than 200 million euros, and grown to 200+ people. Axelera’s CEO Fabrizio Del Maffeo thinks big, moves fast, and hires missionaries, not mercenaries, as he says in our interview.

“I believe in equipping the next generation of impact champions.”

As the founder of the Center for Sustainable Finance and Private Wealth (CSP), Falko Paetzold is redefining what it means for wealthy individuals to invest with purpose. In this conversation, he reflects on the personal journey that shaped his mission, the structural barriers that keep banks from embracing impact investments, and how CSP empowers the next generation of wealth holders to turn a burden into a force for good.