Verve Ventures connects startups with advisors that know their sector inside out. Nigel Barnes from WG Partners in London is a veteran in the life sciences field. In this interview, he shares his insights about what matters when fundraising and preparing an exit.

Partner, WG Partners

WG Partners is a specialist Life Science Investment Banking boutique that provides corporate advisory, M&A and capital raising services to small & mid cap Life Science companies. Nigel has been working in the financial markets for over thirty years having been a Director of Pharmaceutical Equity Research at ABN AMRO, First Vice President Merrill Lynch European Healthcare Equity Research and a Partner at Sudbrook Associates, a healthcare corporate advisory business. He has a Ph.D. in Pharmacology and has worked in the research laboratories of ICI (AstraZeneca) and Glaxo, at Glaxo he transitioned into Sales & Marketing. Nigel has played an active role in a number of leading corporate transactions, including a number of the major European sector mergers, IPO’s and capital raises.

You have a Ph.D. in pharmacology, you have worked in Pharmaceutical R&D, you were an equity analyst for an investment bank and now you’re an M&A advisor. What was the most exciting time so far?

Perhaps one of the most exciting periods of my career was in my time at Merrill Lynch. I was responsible for the research coverage of the large and midcap pharma and biotech companies. In such a position, you are required to be very responsive to price-sensitive news flow. When companies published financial results or clinical results you are immediately required to make a judgment of what that news means for the company’s valuation, information needed by the equity sales desk and market makers, there was nothing like it to get the adrenaline rushing. But it was also hard work and long days. There’s only so many years that you can deal with that intensity.

Were there any moments that particularly stood out?

I was involved in many significant transactions over the years, a number stand out. Those include the merger between SmithKline and Beecham, the Serono NASDAQ listing, and the simultaneous placing of $2bn, $1bn for the Company and $1bn for the Bertarelli family, which I believe helped fund the America’s Cup win.

The life science boutique WG Partners has worked for more than 75 public and private companies since 2012. Since then, the financial markets have been benign, a good environment for M&A and fundraising. But how has the situation changed since the pandemic hit? I imagine it’s difficult to sell a company over Zoom.

In the public markets, there is still money chasing interesting stories, particularly those that have a COVID angle. With public companies, investors tend to know the story and the management, so there is not so much of a need for face to face meetings. However, for private companies, it is a slightly different story, investors really do need to have face to face management meetings, raising private money at the moment is taking longer than pre-pandemic. However, it can be done. WG recently advised Acacia Research from the US in its acquisition of the Woodford portfolio of public and private life science companies for GBP 224 million, and that was all transacted over Zoom.

But in general, the outlook for life science startups that need to raise funds is difficult?

Raising money for private companies is certainly taking longer given the current pandemic, but that said there is still considerable investor interest in the sector. The pandemic has highlighted there are a number of issues with our healthcare system and its ability to deal with such a situation. As a result, I think investor perception of the value of both anti-infective and diagnostic companies is fundamentally changing. I think it’s becoming evident that Covid-19 isn’t going away anytime soon, it looks as though a vaccine is still some time away, and so antigen and antibody testing are going to be with us for some time yet. Therapeutics against Covid-19 is also very interesting from an investor’s perspective as witnessed by the appreciation on the Synairgen share recently after it reported favorable results for inhaled beta interferon.

Verve Ventures has also financed a startup called Memo Therapeutics that has a therapeutic for Covid-19 in the pipeline and we’ve seen quite some investor appetite.

People have realized that anything related to Covid-19 is not just opportunistic because the problem is likely to be with us for some time. Whilst there are many companies developing diagnostic products the global demand for testing capacity is going to be huge. Every government has been criticized for its lack of preparation, despite the unprecedented situation. Now every government will need as many tests, vaccines, and therapeutics as they can possibly procure. Preparedness is key. The impact on the global economy means that to prevent this happening again there will be significant private and public money available to tackle the problem.

For the startup investor, it is the time of the exit that counts. When do life science startups usually get bought?

If a startup has a product that is of strategic importance to the buyer, a trade sale can happen quite early in the asset’s development. We often see this in the molecular diagnostic space, for example, Stat-Dx was acquired by Qiagen for GBP 135 million, just as its diagnostic platform was being launched. If the product isn’t a must-have, then its likely acquisitions will happen later once a business has achieved a CE mark and generated sales traction and for a therapeutic company, it means at least having some end of phase II data.

When should a startup get in touch with M&A advisors like you?

With a lot of companies, our first contact is in the fundraising phase, usually pre IPO or trade sale.

When a startup has developed a platform technology that can be used to discover a set of different assets, what kind of strategy should it pursue?

Unless there is a lot of new products coming out of that platform, every licensing deal will make an acquisition of the whole platform less attractive. More recently we have seen considerable incoming interest from Chinese investors to participate in equity fundraising in exchange for exclusive Chinese licensing rights of assets. This enables the business to continue to develop the asset with an aim to license to a partner for the larger Western market.

What are red flags for potential acquirers that startup investors should know?

There are things that should be avoided if the business is looking to attract larger institutional investors later on. The shareholding structure should be as uncomplicated as possible, which ideally means a single share class. Another issue can be the owner’s realistic expectation of valuation.

Are there other reasons why a deal might fall apart?

There are multiple reasons for a deal falling over, shareholder expectations, management egos to name but a few.

What should the board do in order to facilitate an exit?

Ensure the testing of the asset, be it a therapeutic or a device is rigorous and complete. The financials for the business are in order, the data room contains the relevant information and run a targeted exit process making sure all potential acquirers are involved in the process.

When early phase startups get bought they often get deferred payments as part of the deal because the outcome of their clinical trials is still unclear. How difficult is it to negotiate how much gets paid now and how much later?

The structure and quantum of such a transaction will depend on the importance of the asset for the acquirer. There are a considerable number of transactions that provide a broad sense of how meaningful an upfront, milestone and royalties should be given the profile of the asset.

Are private equity firms active as buyers in the life sciences space as well?

We’ve been doing a lot of work for PE firms recently but the majority of them are focused on healthcare services such as nursing homes, hospitals, all being EBITDA positive. There are a number of life science specialists that are able to assess early clinical data and make an investment call on early-stage businesses

Of the financing rounds you’ve facilitated with WG Partners, many were either secondary fundraisings or private placements. What is the motivation for these two types of financing?

The secondary fundraisings take place after a company has done an initial public offering and is already listed on the stock market. A lot of these companies don’t increase their shareholder base massively during and after the IPO and did not raise a lot of capital during the process. But if they need capital to grow, that’s when we do a secondary raise by introducing them to specialized life science investors. A private placement, on the other hand, takes place before a trade sale or IPO. It is done to strengthen the balance sheet of the company, because if you’re going into a trade sale negotiation, you want to have a strong bargaining position. It would be very bad if you let your cash balance whittle down before entering such discussions. A buyer who knows this fact will drag out the discussions until you’re really desperate to close a deal.

What is the key to successful fundraising from a startup’s perspective?

The investment thesis always boils down to three or four points. Management needs to understand what these points are and how to communicate them. In almost every case that we see, the corporate presentation needs rewriting and restructuring, and to help with this is one of our specialties. You also need to know if you’re pitching to a general fund manager or a specialist and adjust your presentation accordingly. There is no use in burying a generalist with lots of technical details, even if you’re a scientist at heart.

What do investors want to see and hear to feel comfortable?

One of the most important aspects is the presentation of the management team and the board, and their track record. It’s reassuring when you know that these people have accomplished something before. Then there is the clinical data, the more of it, the better, because it largely de-risks the investment. Last but not least the valuation expectation should be realistic. Every now and then, you come across a situation where management has a wildly inflated idea of what their company should be worth. Truth is, a business is rarely so unique that it can’t be benchmarked against comparable businesses, and management ignores such benchmarks at their own risk.

Written by

Investors

Our sophisticated investors include visionary family offices, leading wealth managers, institutions, founders, and senior executives. These individuals and organizations are all committed to shaping the next generation of innovation.

More News

“Investments are creating the world we live in”

The Global Impact Investing Network helps institutional investors prioritize impact in their portfolios by providing tools, standards and research. Lately, it has put more emphasis on climate solutions. In our interview, Sean Gilbert explains how, in roughly 20 years, impact investing has gone from a simple idea to a movement commanding over 1.5 trillion dollars.

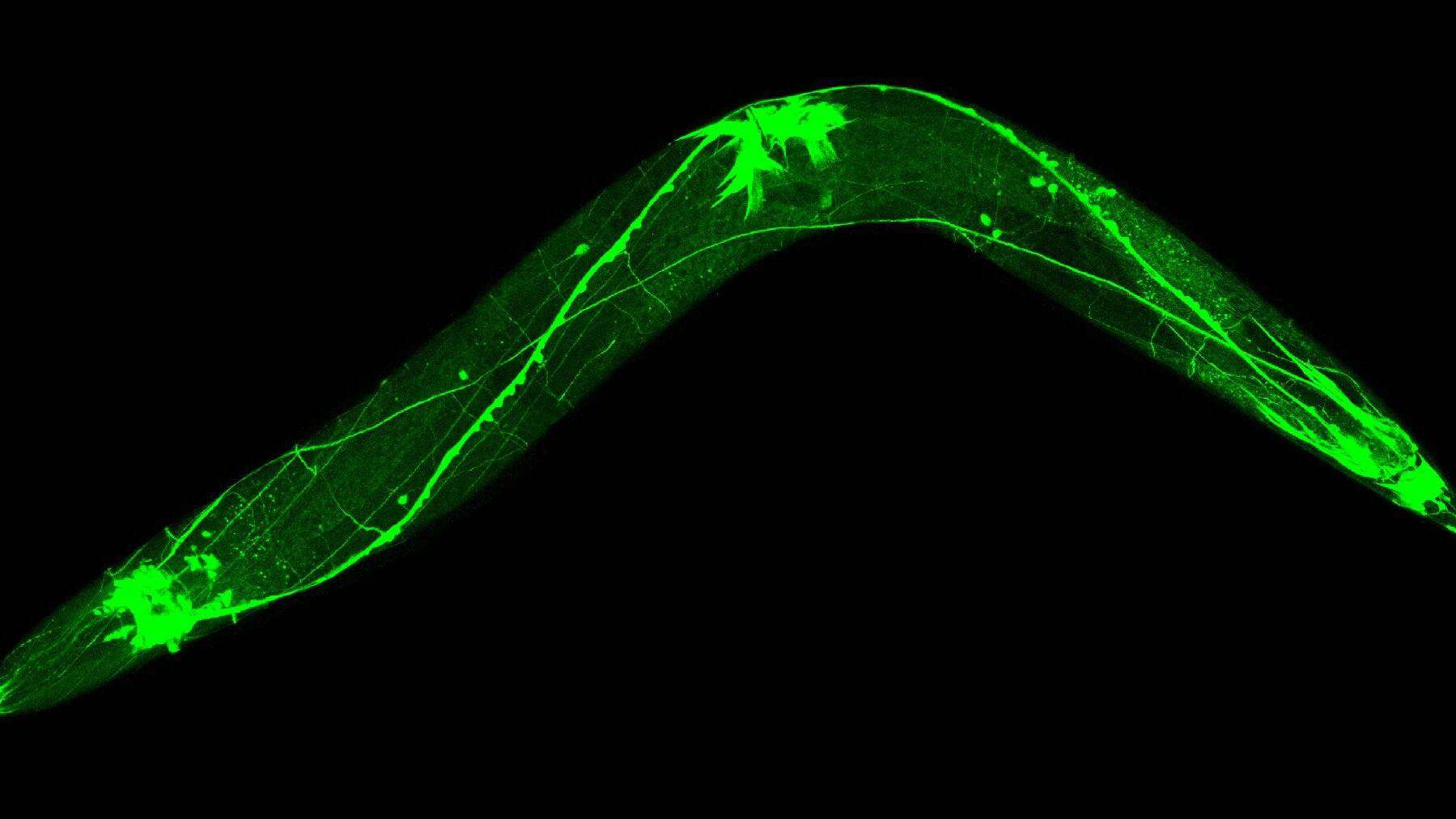

Nagi Bioscience (Life Sciences): CHF 1.8m Seed

Nagi Bioscience has raised CHF 1.8 million from ZKB, NEST and private investors. investiere contributed CHF 1 million to this round.

“Versantis is not just exciting science”

Peter Nicklin is an accomplished manager with more than 30 years of experience in healthcare and pharma. In our interview, he tells us why he joined Versantis.